Revolutionizing Filtration in 2025: How Non-Ferrous Nanofiltration Membrane Manufacturing Is Disrupting Industry Standards and Unlocking New Growth Frontiers

- Executive Summary: Key Findings & Market Highlights

- Market Size and Forecast (2025–2030): Growth Projections and Drivers

- Top Industry Players: Innovations and Strategic Moves

- Emerging Applications: From Water Purification to Industrial Processing

- Technology Deep Dive: Advances in Non-Ferrous Nanofiltration Materials

- Supply Chain & Raw Material Trends: Sourcing, Sustainability, and Risks

- Regulatory Landscape and Industry Standards

- Regional Analysis: Hotspots, Investments, and Expansion Plans

- Competitive Landscape: Barriers, Opportunities, and New Entrants

- Future Outlook: Disruptive Trends and What to Expect by 2030

- Sources & References

Executive Summary: Key Findings & Market Highlights

Non-ferrous nanofiltration membrane manufacturing continues to demonstrate robust growth and technological innovation as of 2025, driven by mounting demand for advanced water treatment, pharmaceutical, food & beverage, and industrial separation processes. Unlike traditional ferrous-based membranes, non-ferrous membranes—typically utilizing polymers, ceramics, or advanced metal oxides—are favored for their enhanced chemical resistance, selectivity, and longevity. Several industry leaders and emerging players are intensifying R&D efforts, scaling up production, and forging strategic collaborations to capitalize on evolving market opportunities.

- Market Drivers: The global push for sustainable water management, stricter regulatory mandates on industrial effluent, and the necessity for high-purity product streams in bioprocessing and specialty chemicals are fueling investment in non-ferrous nanofiltration technologies. Membranes based on polymers such as polyethersulfone (PES), polyvinylidene fluoride (PVDF), and ceramic variants like alumina and zirconia are gaining traction due to their chemical stability and operational flexibility.

- Industry Leaders: Major manufacturers including SUEZ, Pall Corporation, DuPont, and MANN+HUMMEL (through its MICRODYN-NADIR brand) are scaling up non-ferrous membrane production with advanced automated lines and digital quality control. SUEZ and DuPont are notable for their global footprint and broad portfolio covering polymeric and ceramic nanofiltration solutions.

- Innovation Focus: Recent years have seen breakthroughs in nano-structured ceramic membranes and hybrid composite materials, targeting longer service life and resistance to fouling. Companies such as Pall Corporation and MANN+HUMMEL are actively commercializing next-generation non-ferrous membranes with improved flux and selectivity, tailored for harsh chemical environments.

- Regional Trends: Asia-Pacific remains a dynamic growth engine, with heavy investments in industrial wastewater treatment and resource recovery. China and India display rising local production capabilities, supported by domestic companies and joint ventures with multinationals (SUEZ, DuPont).

- Outlook (2025–2027): The sector is forecast to see continued capacity expansion, especially for ceramic and composite nanofiltration lines. Adoption of Industry 4.0 manufacturing practices—such as real-time process monitoring and AI-driven quality analytics—is expected to further enhance efficiency and product performance. Strategic moves, including acquisitions and partnerships between technology developers and end-users, are likely to accelerate commercialization and global adoption.

In summary, the non-ferrous nanofiltration membrane manufacturing industry is poised for sustained growth and disruptive innovation, anchored by technology leadership from established players, emerging regional suppliers, and surging application demand across environmental and industrial sectors.

Market Size and Forecast (2025–2030): Growth Projections and Drivers

The global market for non-ferrous nanofiltration membrane manufacturing is poised for robust growth from 2025 through 2030, driven by escalating demand for advanced water treatment, wastewater recycling, and industrial process optimization. Non-ferrous membranes—those fabricated without iron-based materials, frequently employing ceramics (such as alumina, zirconia, titania), polymers, or composite materials—are increasingly favored for their chemical stability, durability, and compatibility with a range of aggressive environments.

Key players in this sector include Suez, Veolia, GEA Group, and Membrana GmbH, each of which has continued to expand non-ferrous nanofiltration offerings for municipal, industrial, and specialty applications. Suez and Veolia are particularly prominent in ceramic and polymeric membrane production, with established global footprints and ongoing investments in R&D and manufacturing capacity.

In 2025, the non-ferrous nanofiltration membrane market is estimated to reach a multi-billion dollar valuation globally, with Asia-Pacific leading adoption due to rapid urbanization, industrial activity, and tightening environmental regulations. China, India, and Southeast Asian nations are particularly aggressive in upgrading municipal water infrastructure and industrial effluent treatment, spurring demand for durable, non-ferrous membranes.

Growth through 2030 is projected at a compound annual growth rate (CAGR) exceeding 9%, with the market propelled by several drivers:

- Stringent Regulatory Standards: Governments are enacting stricter wastewater discharge and potable water quality requirements, necessitating advanced filtration solutions.

- Industrial Process Optimization: Sectors such as pharmaceuticals, food and beverage, and chemicals are adopting non-ferrous nanofiltration to recover valuable solutes and ensure product purity.

- Technological Advancements: Leading manufacturers like Suez and Veolia are investing in nanomaterial integration and next-generation ceramic and polymeric structures, enhancing performance and reducing total cost of ownership.

- Water Scarcity and Reuse: Chronic water shortages in regions such as the Middle East and parts of Asia are incentivizing adoption of high-performance membranes for desalination and water recycling.

Market expansion is also spurred by collaborations between technology providers and end-users, as well as government incentives for sustainable water management. Notably, Suez and Veolia have reported new manufacturing facilities and pilot projects targeting emerging economies, positioning the sector for sustained double-digit growth through the decade.

Top Industry Players: Innovations and Strategic Moves

The non-ferrous nanofiltration membrane manufacturing sector is witnessing an era of accelerated innovation and strategic repositioning as global demand for advanced water treatment, bioprocessing, and industrial separation intensifies into 2025 and beyond. Key players are investing heavily in R&D to enhance membrane selectivity, durability, and anti-fouling properties, while also expanding production capacities to meet emerging applications in pharmaceuticals, microelectronics, and environmental remediation.

Among the most prominent industry leaders, GE Vernova (formerly part of GE Water & Process Technologies) continues to push boundaries in polymeric and ceramic nanofiltration technologies, emphasizing non-ferrous, metal-oxide, and hybrid material membranes for robust chemical resistance. Their ongoing investments in pilot plants and modular manufacturing lines are geared toward fast-tracking the commercialization of new, high-flux membranes for industrial and municipal water reuse applications.

Another major innovator, Toray Industries, is leveraging its expertise in advanced materials to develop next-generation non-ferrous nanofiltration membranes with enhanced molecular sieve functions. Toray’s recent announcements highlight a strategic focus on scaling up production in Asia and Europe, supported by automation and digital manufacturing techniques to ensure quality and cost efficiency. The company’s collaborations with regional utilities and pharma manufacturers are expected to yield new membrane grades tailored for niche contaminant removal.

In Europe, Evonik Industries stands out for its work with polyether ether ketone (PEEK) and sulfonated polymers, driving forward chemically stable nanofiltration products for harsh process environments. Evonik’s recent expansions in Germany and Singapore are part of a broader initiative to secure supply chains for specialty polymers integral to non-ferrous membrane fabrication.

Meanwhile, Nitto Denko Corporation and its subsidiary, Hydranautics, remain at the forefront of non-ferrous thin-film composite (TFC) membrane design, prioritizing low-pressure, high-rejection membranes for water and solvent purification. Nitto’s investments in digital twin technology and AI-based process modeling are expected to accelerate both product innovation and manufacturing efficiency through 2027.

Strategically, these companies are forming alliances and joint ventures to access new markets and co-develop bespoke nanofiltration solutions. For example, cross-sector collaborations with biotech and semiconductor firms are facilitating the adaptation of non-ferrous nanofiltration to emerging applications like ultrapure water and solvent recovery. Looking ahead, industry analysts anticipate continued consolidation, with leading players acquiring niche membrane start-ups to bolster their intellectual property and accelerate the pace of innovation.

Emerging Applications: From Water Purification to Industrial Processing

The landscape of non-ferrous nanofiltration membrane manufacturing is rapidly evolving in 2025, driven by the escalating demand for advanced separation technologies in applications ranging from water purification to complex industrial processing. Non-ferrous nanofiltration membranes—those constructed from materials other than iron-based metals, such as polymers, ceramics, and other metal oxides—are seeing increasing commercial interest due to their enhanced chemical resistance, durability, and potential for tailored selectivity.

Recent years have witnessed significant investment in scaling up production capabilities and innovation in materials science. Leading manufacturers such as Pall Corporation and Sartorius are expanding their portfolios of polymeric and ceramic nanofiltration membranes specifically engineered for harsh industrial environments. These companies report robust demand for membranes used in the treatment of industrial effluents, pharmaceutical purification, and food and beverage processing, where the non-ferrous nature of the membranes minimizes contamination risks and extends operational lifespan.

In the water purification sector, non-ferrous nanofiltration membranes are increasingly being adopted for the selective removal of heavy metals, micropollutants, and organic contaminants. Companies like inge GmbH (a subsidiary of BASF) have reported progress in the development and deployment of advanced ceramic-based nanofiltration modules, which boast high permeability and fouling resistance—attributes crucial for municipal and industrial water treatment facilities facing stricter regulatory standards.

Emerging applications in chemical and petrochemical processing are also shaping the outlook for non-ferrous nanofiltration membranes. For instance, Membranium (JSC RM Nanotech) is actively commercializing nanofiltration membranes suited for solvent-resistant and acid/base-resistant operations, opening new frontiers in catalyst recovery, solvent purification, and resource recycling. These innovations align with the global push for sustainability and circular economy practices, particularly in regions with stringent environmental regulations.

Looking ahead to the next few years, the trajectory for non-ferrous nanofiltration membrane manufacturing remains positive. Industry bodies such as the American Membrane Technology Association highlight a continued shift toward modular, scalable production systems and the integration of smart monitoring technologies to enhance membrane performance and lifecycle management. With ongoing R&D and cross-sector collaborations, the sector is poised to deliver membranes with improved selectivity, flux, and operational robustness, accelerating their adoption across a growing array of applications beyond traditional water treatment—solidifying their role as a cornerstone technology in sustainable industrial processing.

Technology Deep Dive: Advances in Non-Ferrous Nanofiltration Materials

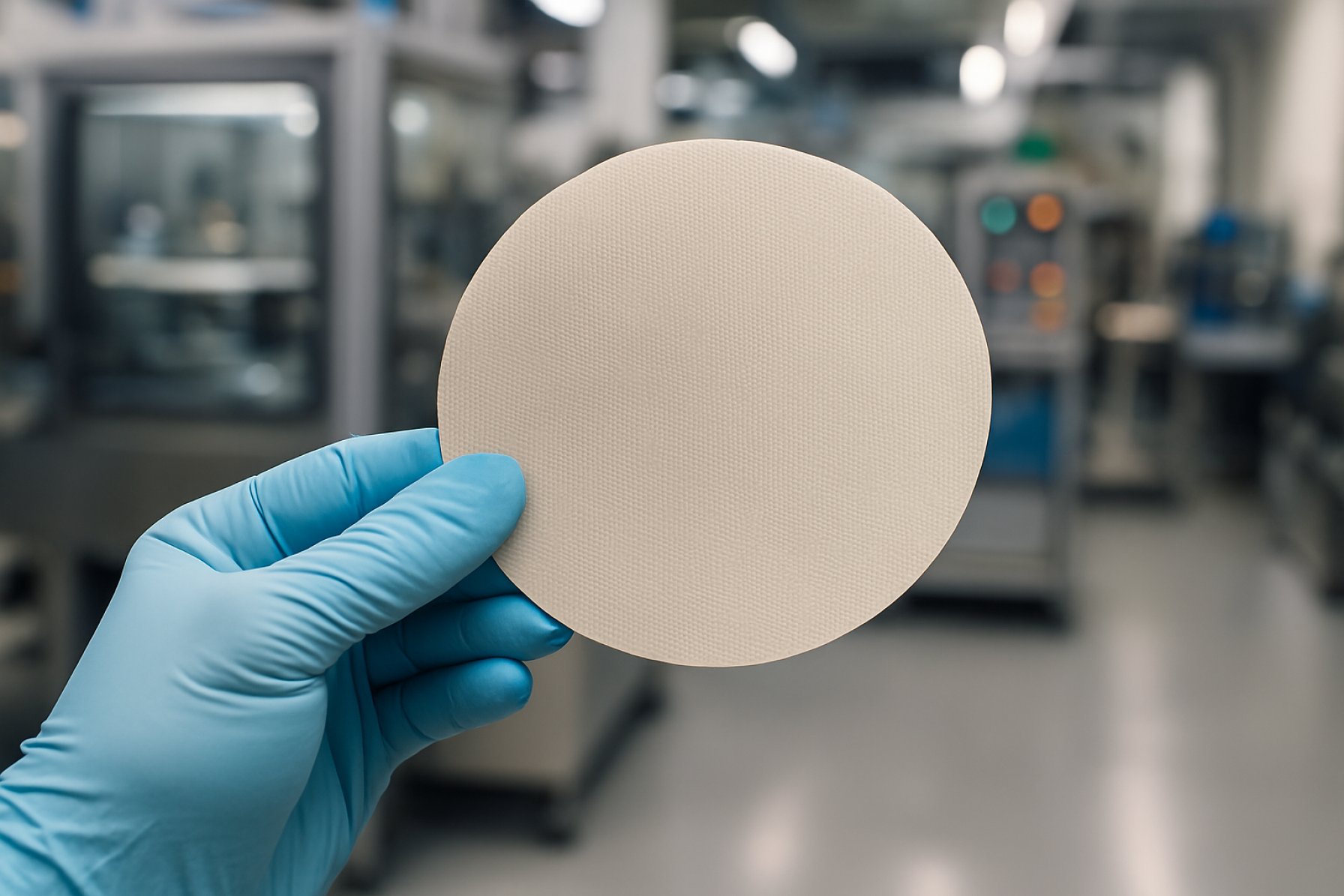

The landscape of non-ferrous nanofiltration membrane manufacturing is experiencing significant advances as of 2025, driven by the escalating demand for efficient separation technologies in water treatment, pharmaceuticals, and industrial processes. Non-ferrous nanofiltration membranes—primarily composed of materials such as polymers, ceramics, and carbon-based compounds—are gaining traction due to their ability to resist corrosion, fouling, and their compatibility with a wide range of process chemistries.

Polymeric nanofiltration membranes, especially those based on polyethersulfone (PES), polyvinylidene fluoride (PVDF), and polyamide (PA), remain the industry standard for water and wastewater applications. Leading global manufacturers such as Toray Industries and Lenntech are continuously optimizing membrane porosity and surface chemistry to enhance selectivity and flux. Toray, for instance, employs advanced interfacial polymerization and phase inversion techniques to control pore size at the nanometer scale, improving contaminant rejection and operational lifespan.

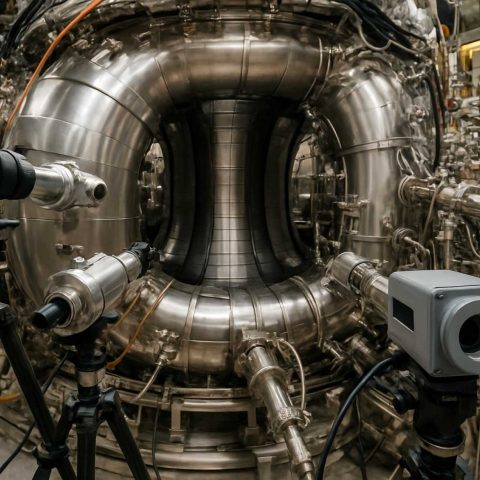

Ceramic nanofiltration membranes, composed primarily of alumina, titania, or zirconia, offer exceptional chemical and thermal stability. Companies like Membrane Solutions and Aker BioMarine are investing in scalable sintering and sol-gel processes to reduce costs and enable broader adoption in harsh industrial environments. These membranes are particularly suited for applications involving aggressive solvents or high-temperature operations, where polymeric alternatives may fail.

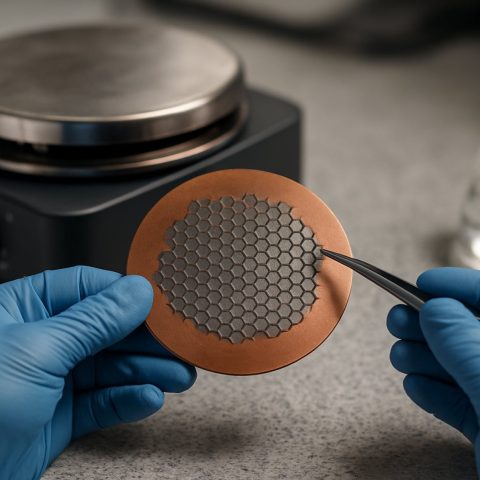

Recent years have also seen a surge in research and pilot-scale implementation of carbon-based nanofiltration membranes, notably those incorporating graphene oxide (GO) and carbon nanotubes (CNTs). Industry leaders such as SUEZ and DuPont are collaborating with research institutions to develop next-generation membranes that combine mechanical strength, anti-fouling properties, and tunable pore sizes. These technologies, though still transitioning from laboratory to commercial scale, are anticipated to reshape the market by 2027, providing superior performance for pharmaceutical and high-value separations.

The outlook for non-ferrous nanofiltration membrane manufacturing over the next several years points to continued material innovation, greater automation in production lines, and a focus on sustainability. Manufacturers are integrating green chemistry principles and recyclable materials to meet tightening environmental regulations. With growing investments from both established companies and new entrants, the sector is poised for robust growth, especially in regions facing acute water scarcity and stringent effluent norms.

Supply Chain & Raw Material Trends: Sourcing, Sustainability, and Risks

The supply chain for non-ferrous nanofiltration membrane manufacturing is evolving rapidly in 2025, shaped by shifting raw material sourcing strategies, sustainability imperatives, and persistent risk factors. Non-ferrous membranes—typically based on ceramics (such as alumina, titania, zirconia), polymers, and advanced composites—require specialized, high-purity inputs. As demand for nanofiltration rises in water treatment, pharmaceuticals, and industrial processing, major producers are re-evaluating sourcing models to ensure both supply security and compliance with tightening environmental standards.

Key ceramic membrane suppliers, including Mott Corporation (USA), TAMI Industries (France), and Membrane Solutions (China/USA), continue to rely on alumina and titania sourced globally, with notable concentration in Australia, China, and India for alumina, and China as the dominant source for titania. Fluctuations in raw material pricing and export policies, particularly from China, present ongoing risks. Recent years have seen some diversification, with European and North American manufacturers investing in secondary sourcing and recycling initiatives to decrease dependence on single markets.

Polymeric nanofiltration membranes, produced by companies such as Toray Industries (Japan) and DuPont (USA), use polyethersulfone (PES), polyvinylidene fluoride (PVDF), and related polymers. These materials are subject to the volatility of the petrochemical sector and to new regulatory scrutiny around PFAS and other persistent substances. Recent investments in bio-based and recycled feedstocks are noted, with Toray Industries and DuPont both announcing pilot projects focused on more sustainable polymer supply chains for filtration applications.

Sustainability is also advancing as a decisive factor, with companies aligning to international frameworks like the UN Sustainable Development Goals and launching closed-loop programs for spent membranes. For example, Mott Corporation has highlighted in its corporate disclosures a focus on reclaiming and reusing ceramic elements, while Toray Industries and DuPont report efforts to lower lifecycle emissions and overall environmental footprint in membrane manufacturing.

Risks in 2025 remain pronounced regarding geopolitical tensions, particularly in East Asia, and in the face of growing climate-related disruptions to mining and chemical processing. Companies are responding with increased inventory buffers, regionalization of sourcing, and digital supply chain monitoring. The outlook for the next few years suggests continued diversification and a drive towards greener and more resilient supply networks, as regulatory, market, and climate pressures converge on the non-ferrous nanofiltration membrane sector.

Regulatory Landscape and Industry Standards

The regulatory framework for non-ferrous nanofiltration membrane manufacturing is evolving rapidly as global demand grows for advanced water treatment, industrial separation, and environmental remediation solutions. In 2025, the focus is intensifying on harmonizing standards, ensuring product safety, and addressing the unique risks and benefits associated with nanomaterials.

Regulatory oversight is primarily shaped by national and international bodies governing water treatment technologies, materials safety, and nanotechnology. In the United States, the U.S. Environmental Protection Agency (EPA) oversees aspects related to water purification membranes, especially under the Safe Drinking Water Act and the Toxic Substances Control Act, which both cover the use and disposal of nanomaterials. The EPA is collaborating with manufacturers to update guidelines on the environmental fate and toxicity of nanostructured materials used in non-ferrous membranes, as companies report increasing use of advanced ceramics, titanium dioxide, and other metal oxides.

In Europe, the European Union (EU) regulates nanofiltration membranes through the REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) framework, which mandates disclosure of nanomaterial composition and safety data for all imported or manufactured products above certain thresholds. The EU is also advancing the implementation of the Drinking Water Directive (revised 2021), which sets stringent requirements for materials in contact with drinking water, directly impacting membrane manufacturers.

Industry standards are being developed and updated in parallel. The International Organization for Standardization (ISO) and the American National Standards Institute (ANSI) drive the creation of voluntary consensus standards for nanofiltration membranes, including ISO 10993 for biocompatibility and performance, and the emerging ISO/TC 229 for nanotechnologies. These standards address critical performance metrics, material characterization, and health and safety, guiding manufacturers such as DuPont, LANXESS, and Veolia in product development and international trade.

Over the next few years, increased adoption of non-ferrous nanofiltration technologies—particularly in Asia-Pacific—will drive calls for regional harmonization of standards. Countries such as China and Japan are investing in their own regulatory frameworks, with agencies like China’s Ministry of Ecology and Environment and Japan’s Ministry of Economy, Trade and Industry expanding oversight of nanomaterial use and emissions. Industry leaders are expected to play a proactive role in shaping future regulations and standards by participating in technical committees and pilot projects, influencing best practices across the global supply chain.

Regional Analysis: Hotspots, Investments, and Expansion Plans

The global landscape for non-ferrous nanofiltration membrane manufacturing is rapidly evolving, with several notable regional hotspots emerging in 2025. The market’s growth is primarily driven by heightened demand for advanced water treatment, industrial separation, and resource recovery technologies, with Asia-Pacific, North America, and Europe leading investment and capacity expansion activities.

Asia-Pacific remains the epicenter for production and innovation, propelled by robust investments in industrial and municipal wastewater treatment. China, in particular, is home to several prominent manufacturers scaling up non-ferrous (e.g., ceramic, polymeric with non-ferrous additives, and metal oxide) nanofiltration membrane production. Major domestic players are expanding their manufacturing bases and R&D capabilities, aiming to supply both domestic and export markets. For instance, China National Petroleum Corporation and SUEZ (which has significant operations in China) are investing in local membrane production facilities and pilot projects, targeting industrial reuse and zero-liquid-discharge applications.

In Japan and South Korea, a strong tradition of materials science innovation is fostering next-generation non-ferrous nanofiltration membrane development, particularly for semiconductor, pharmaceutical, and specialty chemical industries. Companies such as Toray Industries and Mitsubishi Chemical Group are expanding their nanofiltration membrane production lines, integrating advanced inorganic and hybrid materials for enhanced selectivity and lifespan.

North America is experiencing a surge in both public and private sector investment in membrane manufacturing, with a focus on upgrading water infrastructure and supporting sustainable industrial operations. The United States is home to several established membrane manufacturers such as DuPont and Pall Corporation, both of which have announced expansion of their nanofiltration product portfolios and manufacturing footprints. These expansions are supported by federal funding for water reuse and infrastructure modernization, as well as by growing interest in lithium extraction and critical minerals recovery, where non-ferrous nanofiltration membranes are increasingly adopted.

In Europe, regulatory pressures regarding water reuse and industrial effluent management are driving the adoption and local manufacturing of advanced membrane technologies. Veolia and SUEZ, both headquartered in France, are investing in new production lines and pilot facilities across the continent, with a particular focus on energy efficiency and circular economy applications. The European Union’s Green Deal initiatives are expected to further accelerate investments in non-ferrous nanofiltration manufacturing capacity through 2025 and beyond.

Looking ahead, regional competition and collaboration are expected to intensify, with substantial cross-border investments, technology transfer, and joint ventures. Innovation clusters in Asia-Pacific, North America, and Europe will continue to shape the global supply landscape, while emerging markets in the Middle East and Latin America are also poised to attract manufacturing investments, particularly for desalination and resource recovery projects.

Competitive Landscape: Barriers, Opportunities, and New Entrants

The competitive landscape of non-ferrous nanofiltration membrane manufacturing in 2025 is characterized by both persistent barriers and emerging opportunities, with established players competing alongside a new cohort of technology-driven entrants. Historically dominated by established filtration and specialty materials companies, the sector is experiencing heightened competition as water scarcity and industrial sustainability targets drive global demand for advanced membrane solutions.

Key barriers to entry remain substantial. Non-ferrous nanofiltration membranes—composed of polymers, ceramics, or composites rather than traditional metal oxides—require sophisticated production infrastructure, rigorous quality control, and proprietary know-how. Capital expenditure for membrane casting, surface modification technologies, and pilot-scale testing facilities is significant. Furthermore, navigating international certification and regulatory approvals, such as NSF/ANSI or ISO standards, continues to pose challenges for smaller entities.

Market incumbents like Hydranautics, a subsidiary of Nitto Denko, and SUEZ Water Technologies & Solutions maintain their competitive edge through integrated manufacturing, established distribution networks, and ongoing R&D. DuPont has expanded its membrane portfolio with acquisitions and in-house innovation, focusing on membranes with enhanced selectivity and chemical resistance for industrial and municipal applications. Meanwhile, Toray Industries continues to invest in non-ferrous membrane manufacturing with a focus on energy-efficient solutions and long operational lifespans, leveraging their expertise in polymer science.

The sector is witnessing increased activity from new entrants, particularly start-ups and university spin-offs leveraging advances in nanomaterial synthesis, membrane surface functionalization, and scalable roll-to-roll manufacturing. For example, some are utilizing graphene oxide or metal-organic frameworks (MOFs) in polymer matrices to enhance permeability and fouling resistance. However, the path from laboratory innovation to commercial-scale manufacturing remains arduous, requiring partnerships or licensing agreements with established producers for market access and validation.

Opportunities in the coming years are shaped by industrial water reuse mandates, stricter brine discharge regulations, and a growing demand for resource recovery in sectors such as pharmaceuticals, food processing, and microelectronics. Regions such as the Asia-Pacific are anticipated to be focal points for investment and expansion, given their manufacturing base and acute water management needs.

Looking ahead, the competitive landscape will likely see further consolidation among major players, increased collaboration between material innovators and large manufacturers, and a gradual lowering of entry barriers as pilot-scale successes demonstrate scalability. Nonetheless, differentiation through proprietary materials, intellectual property, and application-specific customization will remain critical for both established firms and ambitious newcomers.

Future Outlook: Disruptive Trends and What to Expect by 2030

The non-ferrous nanofiltration membrane manufacturing sector is poised for significant transformation through 2030, propelled by advancements in materials science, increasing demand for sustainable water treatment, and the rising need for selective separation technologies across diverse industries. As of 2025, several disruptive trends are shaping the outlook for this field, with both established and emerging players investing heavily in innovation and capacity expansion.

A major driver is the shift towards metal oxide, ceramic, and polymeric membranes that exclude ferrous components, motivated by the pursuit of higher chemical resistance, improved mechanical stability, and lower contamination risk in critical applications. Companies such as Pall Corporation and SUEZ have highlighted the scalability of non-ferrous membranes in pharmaceutical, food & beverage, and semiconductor manufacturing, where purity requirements are stringent. In 2025, SUEZ continues to expand its advanced ceramics product portfolio, targeting both water reuse and industrial process streams, while Pall Corporation invests in pilot plants featuring non-ferrous nanofiltration modules for biotechnology and microelectronics clients.

A parallel trend is the adoption of novel nanomaterials—such as graphene oxide, alumina, and zirconia—for next-generation membrane fabrication. These materials offer tunable pore sizes and enhanced fouling resistance, which are critical for ultrafiltration and nanofiltration processes. Mott Corporation, for example, is developing custom porous metal and ceramic membrane solutions tailored for aggressive chemical environments, leveraging their expertise in powder metallurgy and precision filtration. Meanwhile, LiqTech International has scaled up its production of silicon carbide membranes, which are inherently non-ferrous, for industrial wastewater and oil & gas applications.

Sustainability is also an overarching theme, with manufacturers prioritizing eco-friendly production methods and recyclable membrane materials. As regulatory scrutiny on water discharge and resource usage intensifies, non-ferrous membranes are being integrated into zero-liquid discharge (ZLD) systems and circular water management frameworks. Companies are increasingly collaborating with end-users and research institutes to optimize membrane lifespans, reduce energy consumption, and facilitate end-of-life recycling.

Looking ahead to 2030, the sector is expected to witness further breakthroughs in membrane chemistry and module engineering, enhanced by digitalization and process automation. Integration of artificial intelligence for predictive maintenance and process optimization is anticipated, with leading firms like SUEZ and Pall Corporation actively exploring smart membrane systems. The outlook is one of robust growth, with non-ferrous nanofiltration positioned as a cornerstone technology for resilient, sustainable, and high-purity separations across global industries.

Sources & References

- SUEZ

- Pall Corporation

- DuPont

- MANN+HUMMEL

- Veolia

- GEA Group

- GE Vernova

- Evonik Industries

- Sartorius

- Membranium (JSC RM Nanotech)

- American Membrane Technology Association

- Lenntech

- Membrane Solutions

- TAMI Industries

- European Union

- International Organization for Standardization

- American National Standards Institute

- LANXESS

- Veolia

- Mitsubishi Chemical Group

- LiqTech International