Semiconductors – those tiny silicon chips – are the brains of modern electronics, found in everything from smartphones and cars to data centers and fighter jets. In 2024, global semiconductor sales surged to over $600 billion and could hit $1 trillion by 2030, underscoring how critical chips have become to the world economy deloitte.com, blog.veolianorthamerica.com. These microchips enable trillions of dollars in downstream products and services, forming the hidden foundation of our digital lives steveblank.com. Yet over the past two years, semiconductor production has become a high-stakes arena of innovation and geopolitical tension. A pandemic-fueled chip shortage showed how fragile the supply chain can be, idling factories and driving up prices. At the same time, nations are racing to boost domestic chipmaking for economic and security reasons, pouring hundreds of billions into new fabs (chip fabrication plants) and triggering a global “chip war.”

This report provides a comprehensive, up-to-date tour of the semiconductor world – explaining what semiconductors are and how they work, how chips are manufactured end-to-end, who the major players are (companies and countries) at each stage, and where the vulnerabilities lie in the supply chain. We’ll also delve into the cutting-edge technologies and materials that make modern chips possible, the latest innovations and R&D trends, and the geopolitical and policy battles reshaping the industry. Finally, we examine the economic impact of the semiconductor sector, its environmental footprint, and looming workforce challenges. From recent expert insights to key developments in 2024-2025, this report will illuminate why semiconductor production is one of the most important – and hotly contested – domains on the planet today.

What Are Semiconductors and How Do They Work?

Semiconductors are materials (like silicon) that can act as an electrical conductor or insulator under different conditions, making them perfect for controlling electric current techtarget.com. In practical terms, a semiconductor device (chip) is essentially a network of tiny electrical switches (transistors) that can be turned on or off by electric signals. Modern integrated circuits pack billions of these transistor switches onto a fingernail-sized chip, allowing complex computations and signal processing. “In simple terms, a semiconductor is an electrical switch that can be turned on and off by electricity. Most modern technology is made of millions of these tiny, interconnected switches,” explains a TechTarget engineering primer techtarget.com.

Because they can precisely control current flow, semiconductor chips serve as the “brains” or “memory” of electronic devices. Logic chips (like CPUs, GPUs, AI accelerators) process data and make decisions, memory chips store information, and analog/power chips interface with the physical world. By doping pure semiconductor crystals with tiny impurities, manufacturers create components like transistors, diodes and integrated circuits that exploit quantum physics to switch and amplify electrical signals techtarget.com. The result is that semiconductors can perform arithmetic, store binary data, and interface with sensors/actuators – capabilities that underlie virtually all modern tech, from digital communications to appliances and medical equipment steveblank.com.

Today’s chips are astonishing feats of engineering. A cutting-edge processor might contain tens of billions of transistors etched in silicon, with features as small as a few nanometers (on the scale of atoms). For example, Apple’s M1 Ultra chip packs 114 billion transistors on a single piece of silicon bipartisanpolicy.org. These transistors switch on and off at gigahertz speeds, enabling the device to perform billions of operations per second. In short, semiconductors have become the foundational technology of the modern world, powering everything from smartphones and cars to cloud servers and industrial machinery. It’s often said that “semiconductors are the new oil” – an essential resource that nations and industries depend on for progress and security.

How Chips Are Made: The Semiconductor Manufacturing Process

Building a microchip is one of the most complex manufacturing processes ever devised – “a business that manipulates materials an atom at a time” in factories costing tens of billions of dollars steveblank.com. It all starts with raw materials and ends with finished chips packaged for use. Here’s an overview of the end-to-end chip fabrication process:

- Raw Silicon to Wafer: Common sand (silicon dioxide) is refined into pure silicon. A silicon crystal ingot is grown and then sliced into thin wafers (circular discs) that will hold thousands of chips bipartisanpolicy.org. Each wafer looks shiny and smooth, but at the microscopic level it’s a pristine lattice of silicon atoms.

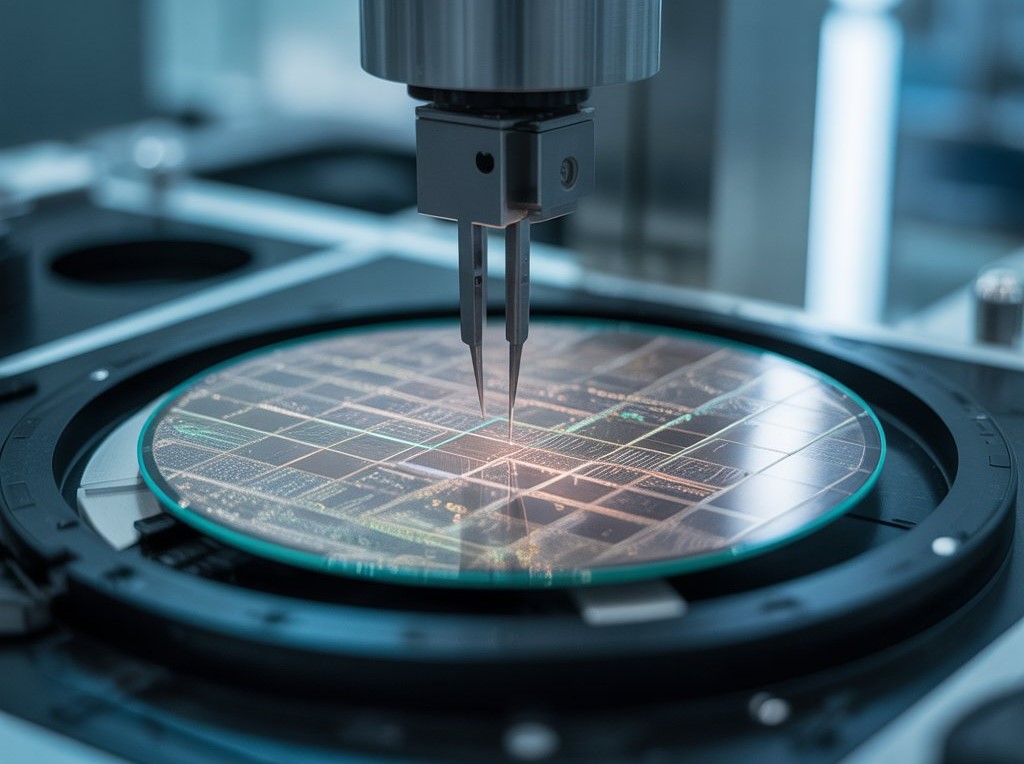

- Front-End Fabrication: The real magic happens in the cleanroom “fab” where complex circuits are constructed on each wafer. Chip fabrication involves hundreds of precise steps, but the key stages include: deposition of ultra-thin material layers onto the wafer; photoresist coating; photolithography (using focused light to etch tiny patterns onto the wafer via masks, much like printing a circuit blueprint); etching and doping (removing material and implanting ions to form transistors and interconnects); and repeating these steps layer by layer bipartisanpolicy.org. Transistors – essentially the on/off switches – are built by these patterned layers that create microscopic electrical pathways. This is nanometer-scale fabrication – modern chips may have 50+ layers of circuitry and features as small as 3 nm (nanometers) wide. Each step must be controlled with atomic precision; a speck of dust or slight misalignment can ruin the chip.

- Back-End and Packaging: After front-end fabrication, the finished wafer contains a grid of many individual chips (dies). The wafer is cut into separate chips, and each chip is then packaged. Packaging involves mounting the fragile chip on a substrate, wiring it to tiny gold or copper contacts, and encasing it (often with a protective resin and heat-spreader) so it can be handled and integrated onto circuit boards bipartisanpolicy.org. The packaged chip is what gets soldered onto your phone’s motherboard or PC’s circuit board. Chips also undergo rigorous testing at this stage to ensure they work as intended.

Despite the simplified summary above, making advanced semiconductors is a massively complex, multi-month process. A leading-edge chip might require >1,000 process steps and extreme precision equipment. For example, the latest photolithography machines (which project circuit patterns with ultraviolet light) can cost over $300 million each, and each such machine “can consume as much electricity as a thousand homes,” according to Bloomberg bipartisanpolicy.org. These tools use Extreme Ultraviolet (EUV) light to carve ultrasmall features and are so sophisticated that only one company in the world (ASML in the Netherlands) currently makes them patentpc.com. The capital expense is enormous: building a new chip fab can take 3+ years and over $10 billion in investment bipartisanpolicy.org. Leading firms like TSMC, Samsung, and Intel spend tens of billions annually on expanding and equipping fabs.

The payoff for all this effort is astonishing technology: a single 12-inch wafer, once fully processed, may hold hundreds of finished chips containing collectively trillions of transistors steveblank.com. Each chip is tested and can perform billions of calculations per second once deployed. The tiny scale and high density of modern chips give them incredible power. As one industry blog noted, that wafer in the cleanroom “has two trillion transistors on it” manufactured with atomic-level contro lsteveblank.com. This fabrication prowess – continually refined over decades – is what enables our powerful and affordable electronics today.

Major Players in the Semiconductor Supply Chain (Companies & Countries)

Semiconductor production isn’t handled by a single type of company; it’s an intricate ecosystem of firms, each specializing in different stages. If we peek inside the supply chain, we find a network of hundreds of highly specialized players globally, all dependent on each other steveblank.com. Here are the major categories of players and who dominates them:

- Chip Designers (Fabless Companies): These companies design semiconductor chips but outsource the actual manufacturing. They create the blueprints and intellectual property for chips. Many of the world’s best-known chip brands – including Apple, NVIDIA, Qualcomm, AMD, Broadcom – are fabless designers. The U.S. has a strong lead in this segment (home to ~50% of fabless firms patentpc.com), along with companies in Europe (e.g. ARM in the UK for chip IP cores steveblank.com) and Asia. Fabless firms focus on R&D and innovation in chip architecture, then hire contract manufacturers to produce the chips.

- Integrated Device Manufacturers (IDMs): These are giants like Intel, Samsung, and Micron that both design and manufacture chips in-house. Intel (USA) historically led in microprocessor design/fabrication for PCs and servers, Samsung (South Korea) and Micron (USA) do this especially in memory chips. IDMs control their own fabs and produce chips for their own products (and sometimes for others). However, the trend in recent decades has been a shift toward the fabless-foundry model for efficiency.

- Semiconductor Foundries (Contract Manufacturers): Foundries are the chip fabs that actually fabricate chips (for fabless clients or IDMs that outsource some production). This segment is dominated by Asian firms. Taiwan’s TSMC (Taiwan Semiconductor Manufacturing Co.) is the unrivaled leader, single-handedly controlling ~55% of the global foundry market as of 2023 patentpc.com. TSMC is the go-to manufacturer for Apple, AMD, NVIDIA and many others, especially for the most advanced chips (5nm, 3nm nodes). Samsung in South Korea is the second-largest foundry (around 15–20% share) patentpc.com, also producing advanced logic chips. Other notable foundries include GlobalFoundries (U.S., focusing on mid-range nodes), UMC (Taiwan), and SMIC (China’s largest foundry). Notably, Taiwan and South Korea together account for the vast majority of cutting-edge chip production – in fact, about 92% of the world’s most advanced (<10nm) chip manufacturing capacity is in Taiwan alone, according to a 2023 U.S. government report usitc.gov. This highlights how concentrated chipmaking has become in a few locales.

- Memory Chip Makers: Memory is a specialized sub-sector, but vital (for RAM, flash storage, etc.). It’s dominated by IDMs like Samsung and SK Hynix (both South Korean), and Micron (USA). For example, Samsung and SK Hynix together produce over 70% of the world’s DRAM memory chips patentpc.com. These firms invest heavily in fabrication of DRAM and NAND flash memory, often in huge facilities in South Korea, Taiwan, the US, Japan, and China.

- Semiconductor Equipment Suppliers: These companies build the tools and machinery for chip fabrication – an absolutely critical, high-tech industry in itself. Leading equipment makers include ASML (Netherlands), which exclusively makes EUV lithography systems essential for 7nm-and-below chips patentpc.com; Applied Materials, Lam Research, KLA (all U.S.), which supply deposition, etching, and inspection equipment; Tokyo Electron and Nikon (Japan) for lithography and etch tools; and others. Without these cutting-edge machines, fabs cannot operate. The U.S., Japan, and the Netherlands historically dominate semiconductor equipment – one reason export restrictions on these tools have become a geopolitical issue (more on that later).

- Materials and Chemical Suppliers: Chipmaking also relies on a complex supply of specialized materials – from ultra-pure silicon wafers to exotic chemicals and gases. A few examples: Shin-Etsu Handotai and SUMCO (Japan) produce a large share of the world’s silicon wafers. JSR, Tokyo Ohka Kogyo (Japan) and others supply photoresists (light-sensitive chemicals) steveblank.com. Industrial gas firms like Linde, Air Liquide provide the over 100 types of gases used in fabs (e.g. fluorine, neon, argon) steveblank.com. Many of these critical materials are concentrated in Japan, China, and Europe. For instance, Japan has long been a powerhouse in semiconductor chemicals, while China refines many rare minerals used in chips (like gallium and germanium). This means countries that dominate raw materials (China, Russia, etc.) and those excelling in specialized chemicals (Japan) have outsized roles in the supply chain.

- EDA and IP Providers: Before manufacturing, chips need to be designed and verified. Electronic Design Automation (EDA) software tools are provided by essentially three major companies – Synopsys, Cadence (both U.S.) and Siemens EDA (Mentor Graphics) – all American or American-allied firms steveblank.com. They have a near-monopoly on the complex software used by engineers to lay out billions of transistors and run simulations. Additionally, core designs (like CPU cores) are often licensed from IP companies like ARM (UK) which provides blueprint designs used in most mobile processors steveblank.com. These upstream players are crucial enablers for the whole industry.

- Outsourced Semiconductor Assembly and Test (OSAT): Once wafers are made, specialized contractors handle the packaging and testing of chips. Major OSAT companies include ASE Technology Holding (Taiwan) – the world’s largest packager – and Amkor (USA), as well as many based in China, Malaysia, and Vietnam. In fact, Southeast Asia has become a hub for chip assembly: for example, Malaysia performs about 13% of the world’s chip packaging and testing services patentpc.com, and Vietnam’s OSAT sector is growing fast patentpc.com. These stages are labor-intensive, and companies often locate them in countries with skilled workforce and lower costs.

In terms of countries: different nations specialize in different links of this chain. Taiwan is the superstar of chip fabrication, especially advanced logic chips – it alone had ~65% of foundry market share in 2023 patentpc.com and is indispensable for cutting-edge chips (with TSMC’s dominance). South Korea is a leader in memory chips and also in foundry (Samsung), accounting for ~20% of global chip output patentpc.com. The United States remains a leader in chip design (home to many fabless giants and IDMs like Intel) and in certain manufacturing equipment, but the U.S. share of actual manufacturing has fallen from 37% in 1990 to around 12% by 2023 patentpc.com as production migrated to Asia. This decline is what the U.S. government now aims to reverse via incentives (more on that below). China is a special case – it is the largest consumer of chips (assembling electronics for the world), and produces a lot of mature-node chips and packaging, but relies on imports for the most advanced chips. As of 2023, China’s self-sufficiency in semiconductors was only ~16% patentpc.com, and it spent a staggering $350 billion on imported chips in 2022 patentpc.com. However, China is investing heavily to increase domestic production to 70% by 2030 patentpc.com, building up companies like SMIC and YMTC (memory). Japan was a dominant chip producer in the 1980s and is still a major player in materials and equipment. Today Japan is re-entering manufacturing via partnerships (e.g. TSMC is building a fab in Japan, and a new consortium Rapidus aims to make 2nm chips domestically), leveraging its strength in quality manufacturing and government support. Europe (EU) has some chipmakers (e.g. Infineon in Germany for automotive chips, STMicroelectronics in France/Italy, NXP in the Netherlands) and is home to ASML, but overall Europe’s share of global chip production is around 8-10% techhq.com. The EU is pushing to double that by 2030 (to ~20%) via its own Chips Act and by attracting TSMC and Intel to build fabs in Europeconsilium.europa.eu. Beyond these, countries like Malaysia, Vietnam, Thailand, Philippines play crucial roles in assembly and testing (providing resilience and diversification in later stages of the supply chain) patentpc.com. Even new aspirants like India and Saudi Arabia have announced big investments to enter the semiconductor arena (India offering incentives for fabs, and Saudi Arabia planning $100B by 2030 to build a chip industry) patentpc.com.

In summary, semiconductor production is a globally distributed effort, but with critical choke points – a few companies or countries lead each segment. For instance, just three companies (TSMC, Samsung, Intel) account for the vast majority of advanced chip output, and just three countries (Taiwan, South Korea, China) manufacture nearly all chips today patentpc.com. This concentrated structure has big implications for supply chain security, as we examine next.

Supply Chain Structure and Vulnerabilities

The semiconductor supply chain has been called “the most complex supply chain of any industry” usitc.gov – and recent events have exposed how fragile it can be. From natural disasters to geopolitical conflicts, a host of vulnerabilities threaten the smooth flow of chips. Key chokepoints and risks include:

- Heavy Geographic Concentration: The industry’s geographical clustering means a disruption in one region can stall the world. Nowhere is this more clear than Taiwan’s outsized role. While Taiwan makes about 18% of all chips by volume, it accounts for “around 92% of the world’s most advanced chip manufacturing capacity,” according to a 2023 USITC report usitc.gov. In other words, almost all cutting-edge (sub-10nm) chips come from Taiwan (primarily TSMC), with the remaining from South Korea. This is a huge supply risk – any interruption (a earthquake, a geopolitical crisis) could cripple global tech supply chains usitc.gov. Indeed, experts note that a major disruption to Taiwan’s fabs would be an economic catastrophe far beyond the tech sector. South Korea is another single point of failure: for instance, nearly all high-end memory chips come from two firms there. Recognizing this, countries and companies are now trying to diversify manufacturing geographically (a shift from globalization to “regionalization”) nefab.com, but building new fabs elsewhere takes time.

- Single-Supplier Dependencies: Certain critical inputs depend on sole or very limited suppliers. A prime example is ASML – the Dutch company is the only source of EUV lithography machines needed for top-tier chips patentpc.com. If ASML can’t ship tools (whether due to export bans or production issues), chip advancement stalls. Similarly, key chemicals often have just a few qualified suppliers. For instance, a handful of Japanese firms supply most photoresist chemicals globally. Advanced chip design software (EDA tools) is another bottleneck, dominated by just three U.S.-based vendors. These concentration points mean the whole chain is only as strong as its weakest (or narrowest) link.

- Materials and Natural Resources Risks: Semiconductor fabrication depends on certain rare materials and refined chemicals – and supply shocks to these have caused trouble. The Russia–Ukraine war in 2022 illustrated this: Ukraine supplied about 25–30% of the world’s purified neon gas (used for laser lithography), and Russia supplied a similar share of the world’s palladium (used in some chip processes) usitc.gov. When war disrupted those supplies, it threatened chip production until alternative sources ramped up usitc.gov. Another example came in mid-2023: China retaliated against U.S. tech restrictions by banning exports of gallium and germanium – two obscure metals vital for semiconductor lasers, radio frequency chips, and solar cells deloitte.com. China produces the majority of those elements, so the move sent manufacturers scrambling for other suppliers. These incidents highlight a vulnerability: if a single source of a critical material goes offline, it can bottleneck the entire chip fabrication process.

- Extreme Complexity and Lead Times: It can take months to make a batch of chips and years to build a new fab from scratch. This long lead time means the supply chain cannot quickly snap back from disruptions. During the COVID-19 pandemic, for example, a rapid demand spike combined with shutdowns led to a severe chip shortage in 2021, which took over a year to gradually resolve usitc.gov. The shortage hit automakers particularly hard – factories stalled and the auto industry lost an estimated $210 billion in sales in 2021 due to lack of chips usitc.gov. The complex, just-in-time nature of chip supply (with minimal inventory held) means even a minor glitch – a fire at a Japanese fab, a Texas freeze knocking out plants, or a Taiwanese drought reducing water supply – can cascade into global production delays. We saw this with a fire at a Renesas automotive chip plant in 2021 and power outages in Texas fabs the same year, each causing downstream product delays.

- Fragile “Just-in-Time” Chain: For years, efficiency drove companies to keep inventories low and rely on realtime supply. But that left no buffer for disruptions. The globalized chain was optimized for cost, not resilience. Now, with pandemic lessons, companies and governments are pushing for “resiliency” – building more stockpiles of chips or inputs, “friendshoring” production to trusted countries, and dual-sourcing critical components reuters.com. Still, changes are gradual and costly.

- Geopolitical Fragmentation: Perhaps the biggest emerging vulnerability is the politicization of the chip supply chain. The U.S.-China tech rivalry has led to export controls and blacklists that effectively split the world in two for semiconductors. “In the chip sector, globalization is dead. Free trade is not quite that dead, but it’s in danger,” said TSMC founder Morris Chang in 2023. Over the past year, the U.S. and its allies have increasingly restricted China’s access to advanced chip tech, fearing security implications. This has led China to double down on indigenous tech and even restrict certain exports in return. The result is a more bifurcated supply chain – one where Western-aligned and China-aligned ecosystems might become less interdependent. While this might add some redundancy, it also means less efficiency, higher costs, and potential duplication of efforts across two tech spheres theregister.com. Chang bluntly stated “globalization is almost dead and free trade is almost dead” theregister.com, warning that the golden era of a unified global chip chain is ending. This transition period introduces uncertainty and risk, as companies must navigate complex new rules about who they can sell to and where they can build.

In short, the semiconductor supply chain is a double-edged sword: its global nature delivered remarkable innovation and scale at low cost, but it also created dangerous single points of failure. A drought in Taiwan or a political standoff in the South China Sea isn’t just a local issue – it could disrupt production of smartphones, cars, and datacenter servers worldwide usitc.gov. That recognition is now driving massive efforts to increase resilience – from government subsidies for local fabs to diversification of suppliers. But building redundancy takes time, and in the interim the world remains highly vulnerable to semiconductor supply shocks.

Key Materials and Technologies in Chipmaking

The art of chipmaking relies on a suite of cutting-edge technologies and specialized materials. Understanding these gives insight into why making chips is so challenging (and why only a few players can do it at the highest level):

- Silicon Wafers: The majority of chips are built on silicon – a plentiful element whose semiconducting properties make it ideal. Silicon ingots are sliced into mirror-smooth wafers (300mm diameter for most advanced fabs today). These wafers are the starting canvas for chips. Producing defect-free, pure silicon crystals is itself a high-tech process mastered by just a few companies (mostly in Japan). Other semiconductor materials are also used for niche applications: e.g. gallium arsenide or indium phosphide for high-frequency RF chips, and silicon carbide (SiC) or gallium nitride (GaN) for high-power electronics (like EV motor controllers and 5G base stations), due to their superior electrical properties at high voltages or frequencies. These compound semiconductors are critical for 5G, electric vehicles, and aerospace, and efforts are underway to ramp up their production (often involving U.S., European, and Japanese firms leading in materials science).

- Photolithography Technology: At the heart of modern chip fabrication is photolithography – using light to etch tiny patterns. This tech has pushed into almost sci-fi realms. Current leading-edge fabs use Extreme Ultraviolet (EUV) lithography, which operates at a wavelength of 13.5 nm and involves insanely complex optics, plasma light sources, and vacuum systems. As noted, ASML is the sole maker of EUV scanners patentpc.com. Each EUV machine weighs 180 tons, has thousands of components (Zeiss mirrors, laser-produced plasma light source, etc.), and costs over $300 million bipartisanpolicy.org. EUV allows patterning of features ~7 nm and below with fewer steps. For older nodes (e.g. 28nm, 14nm), fabs use Deep Ultraviolet (DUV) lithography – still complex but a somewhat broader supply base (ASML, Nikon, Canon supply those tools). Progress in lithography has been the key driver of Moore’s Law, enabling the doubling of transistor densities. The next step in lithography is already in the works: High-NA EUV (higher numerical aperture lenses for even finer patterns) targeted for 2nm and below chips by 2025-2026. The whole world of chipmaking largely hinges on advances in this optical technology.

- Chemical Processes and Gases: A modern fab employs an astonishing array of chemicals – from gases like fluorine, argon, nitrogen, silane to liquid solvents, acids, and photoresists. More than 100 different gases (many toxic or highly specialized) might be used in various deposition and etch steps steveblank.com. Photoresist chemicals are light-sensitive polymers spread on wafers to transfer circuit patterns – a niche dominated by Japanese firms steveblank.com. Chemical Mechanical Planarization (CMP) slurries containing nano-abrasives are used to polish wafer layers flat steveblank.com. Even de-ionized ultrapure water is a critical “material” – fabs consume huge volumes to rinse wafers (as discussed in the environmental section). Each material must meet extreme purity requirements, because a single impurity atom or particle can ruin billions of transistors. So the supply of these materials is a high-tech endeavor in itself, often with few qualified suppliers (hence vulnerable to disruption as mentioned earlier).

- Transistor Technology (Node Generations): Chips are often classified by their “node” or transistor size – e.g. 90nm, 28nm, 7nm, 3nm, etc. Smaller is generally better (more transistors per area, higher speed, lower power). How are these tiny transistors made? It involves both lithography to define their small features and clever transistor architecture. The industry moved from traditional flat (planar) transistors to FinFET (3D fin transistors) around the 22nm node to control leakage. Now, at ~3nm, a new design called Gate-All-Around (GAA) or nanosheet transistors is being introduced (Samsung’s 3nm uses GAA, and TSMC/Intel plan GAA at 2nm) – this wraps the transistor’s gate fully around the channel for even better control. These advancements in device structure, along with new materials (e.g. high-κ dielectrics, metal gates), have extended Moore’s Law even as simple scaling gets harder bipartisanpolicy.org. There’s a whole pipeline of R&D into new materials at the transistor level – for instance, using Germanium or 2D materials (like graphene) for channels to boost mobility, or III-V semiconductors for certain layers. While not yet in high-volume production for logic, such materials might appear in coming years as silicon transistors reach physical limits.

- Packaging and Chip Integration Tech: As transistors shrink yields diminishing returns, innovation is shifting to chip packaging and integration. Advanced packaging allows multiple chips (chiplets) to be combined in one package, connected by high-density interconnects. Techniques like TSMC’s CoWoS and SoIC, Intel’s Foveros, and AMD’s chiplet architecture let designers mix and match different “tiles” (CPU cores, GPU, IO, memory) in one module. This improves performance and yield (smaller chips are easier to manufacture defect-free, then tiled together). For example, AMD’s latest CPUs use chiplets, and Intel’s upcoming Meteor Lake does as well. 3D stacking is another tech – putting chips on top of each other, like stacking memory on logic (e.g. HBM high-bandwidth memory stacks) to overcome bandwidth bottlenecks. The industry is standardizing chiplet interfaces (UCIe) so that chips from different vendors might one day be interoperable in a package bakerbotts.com. In short, “chiplets are like Lego bricks – smaller, specialized chips that can be mixed and matched to create more powerful systems,” as MIT Tech Review quipped (illustrating a major innovation trend). This packaging revolution is a key tech strategy to keep improving system performance even if transistor scaling slows.

- Design Software & IP: While not a material, it’s worth noting the EDA (Electronic Design Automation) tools and IP cores used to design chips are crucial technologies in their own right. Modern chips are so complex that AI-assisted EDA is emerging – tools now leverage machine learning to optimize chip layouts and verify designs faster steveblank.com. On the IP side, core designs like ARM’s CPU cores or Imagination’s GPU cores are foundational tech that many chip companies license rather than reinvent, effectively serving as building blocks.

- Emerging Computing Paradigms: Beyond traditional digital chips, new technologies are being explored: quantum computing chips (using qubits made of superconducting circuits or trapped ions) promise exponential speed-ups for certain tasks, though still research-level. Photonic integrated circuits use light instead of electricity for communications and potentially computation at very high speeds with low heat – used in some communications infrastructure already. Neuromorphic chips aim to mimic brain neural networks in hardware for AI applications. While these are not mainstream yet, ongoing R&D could make them part of the semiconductor landscape in coming years.

In summary, making semiconductors requires mastering an astonishing array of technologies – from materials science (growing perfect crystals, chemistry of etching) to optical physics (nano-photonics of lithography) to computer science (design algorithms). The complexity is why only a few ecosystems (Taiwan, South Korea, U.S., Japan, Europe) have full command of these technologies, and why latecomers face steep hurdles to catch up. It’s also why chips are so hard to make – but so miraculous in what they achieve.

Innovations and R&D Directions

The semiconductor industry is driven by relentless innovation – famously encapsulated in Moore’s Law, the observation that transistor counts on chips roughly double every two years. While Moore’s Law is slowing as physics constraints loom, research and development (R&D) in the chip world is more vibrant than ever, exploring new ways to keep improving performance. Here are some key innovations and future directions as of 2024-2025:

- Pushing the Node Frontier: The big players are racing to commercialize the next generations of chip technology. TSMC and Samsung began 3 nanometer production in 2022-2023; now TSMC plans 2 nm fabs by 2025-2026, and IBM (with Rapidus in Japan) even demonstrated a lab prototype 2 nm chip. Intel is aiming to regain process leadership with nodes it calls 20A and 18A (around 2 nm equivalent) by 2024-2025, integrating ribbon-style GAA transistors (“RibbonFET”). Each node shrink demands huge R&D – new lithography tricks, new materials (like cobalt or ruthenium for interconnects, novel insulators), and more EUV layers. There is even talk of sub-1nm (so-called angstrom scale) processes later in the decade, though by then the “nm” labels are mostly marketing – actual feature sizes may be just a few atoms thick.

- Chiplet and Modular Architectures: As mentioned, chiplet-based design is a major innovation to watch. It’s already in use (AMD’s Zen processors, Intel’s upcoming Meteor Lake, Apple’s M1 Ultra which essentially fuses two M1 Max chips via an interposer), and it’s evolving with standard interfaces. This modular approach allows reusing IP blocks, mixing process nodes (e.g. put analog on an older node chiplet, CPUs on a newer node chiplet), and better yields. The UCIe (Universal Chiplet Interconnect Express) consortium formed in 2022 is developing open standards so that, potentially, a company could buy pre-made chiplet components and integrate them – like plugging Lego bricks together. In 2024, we’re seeing chiplets enabling more specialized combos, like integrating AI accelerators or HBM memory stacks easily to scale performance bakerbotts.com. Going forward, this could drastically change how chips are designed and who can produce them (lowering entry barriers for new players who can focus on one chiplet niche).

- Artificial Intelligence (AI) and Specialized Chips: The booming demand for AI computing (e.g. training large neural networks for generative AI) is shaping chip innovation. Traditional CPUs are inefficient for AI workloads, so GPUs (graphics processors) and AI accelerators (TPUs, NPUs, etc.) are in high demand. In 2024, we saw an “AI gold rush” in semiconductors – Nvidia’s data center GPUs, for example, are selling as fast as they can make them, and many startups are designing AI-specific chips. Generative AI chips (spanning CPUs, GPUs, specialized AI accelerators, memory, networking) likely exceeded $125 billion in 2024 revenue – more than double initial projections – making up over 20% of all chip sales deloitte.com. This is spurring R&D into architectures optimized for AI: think tensor processors, neuromorphic chips, in-memory computing (processing data in memory arrays), and even analog computing for AI. Big players like NVIDIA, Google (TPU), Amazon (Inferentia), and startups (Graphcore, Cerebras, etc.) are pushing innovative designs. AMD’s CEO Lisa Su estimated the total market for AI-related chips could reach $500 billion by 2028 deloitte.com – a number larger than the entire semiconductor market of 2023, highlighting the transformative potential of AI. Such forecasts are driving huge investments in AI chip R&D.

- 3D Integration & Heterogeneous Integration: Beyond chiplets side-by-side, 3D stacking (chips on top of each other) is another frontier. Memory stacking (e.g. HBM on GPUs) is already common. The next step is stacking logic chips to shorten connections – for instance, placing cache memory directly atop a CPU core layer for faster access. Research projects are exploring 3D ICs with thousands of vertical interconnects (through-silicon vias or even bonded inter-die connections at nanoscale pitch). Heterogeneous integration refers to merging different technologies (CMOS logic, DRAM memory, photonics, etc.) in one package or stack. The U.S. CHIPS Act is funding advanced packaging and integration facilities because this is seen as a key to future gains when pure scaling slows. In 2024, Intel demonstrated stacking a compute chip on top of an I/O chip with “PowerVia” backside power delivery in between, as part of their forthcoming designs. This is cutting-edge packaging R&D.

- New Materials and Transistor Paradigms: Researchers are also working on post-silicon, post-CMOS technologies. Graphene and carbon nanotubes have tantalizing properties (ultra-fast electron mobility) that could enable far smaller transistors, but integrating them into mass manufacturing is challenging. Still, experimental carbon nanotube FETs have been shown in lab chips (MIT famously made a 16-bit microprocessor entirely out of carbon nanotube transistors a few years ago). 2D semiconductors like molybdenum disulfide (MoS₂) are being studied for ultra-thin channels. Meanwhile, spintronics (using electron spin for memory, like MRAM), ferroelectric FETs, and quantum devices are active research areas that might enhance or replace current tech for certain applications. None of these will hit high-volume production in 2025, but investments now could yield breakthroughs late in the decade. A noteworthy example: IBM and Samsung announced research on VTFET (Vertical Transport FET) in 2021, a novel vertical transistor structure that could theoretically offer a big leap in density by orienting transistors vertically through the chip.

- Quantum Computing and Silicon Photonics: While not directly part of mainstream CMOS roadmaps, both quantum computing and photonic integration are future directions overlapping with semiconductors. Quantum computing R&D has seen billions in investment – companies like IBM, Google, Intel are even making quantum processor chips (though with very different technology – e.g. superconducting circuits at cryogenic temperatures). If quantum computers scale, they might complement classical semiconductors for certain tasks (cryptography, complex simulation) within a decade or two. Silicon photonics, on the other hand, is already merging with traditional chips: integrating optical interfaces for super-fast data links (like between server chips) using tiny lasers and waveguides on-chip. Tech giants (e.g. Intel, Cisco) have photonic chip programs, and startups are working on optical neural networks. In 2024, we saw continued progress with the second generation of optical transceiver chips for datacenters, and research on photonic computing for AI.

- Advanced Memory Technologies: Innovation isn’t only in logic chips. Memory is also evolving: 3D NAND flash is going to 200+ layers (Micron and SK Hynix announced >230-layer chips), and eventually maybe 500+ layers by 2030, stacking memory cells in skyscraper-like fashion. New memories like MRAM, ReRAM, and phase-change memory are under development to potentially replace or complement DRAM and flash, offering non-volatility with better speed or endurance. In 2023, Intel and Micron both showcased advances in these next-gen memories. Computational storage (where memory can do some compute tasks) is another angle.

Overall, the R&D pipeline is rich – from immediate next-gen manufacturing improvements (2nm, GAA transistors) to revolutionary new computing paradigms. The industry is also receiving unprecedented government R&D support: for example, the U.S. CHIPS Act allocates billions for new national semiconductor research centers, and Europe’s Chips Act similarly boosts R&D funding semiconductors.org. These efforts aim to secure leadership in future technologies. One clear trend is massive collaboration between companies, governments, and academia on pre-competitive research (given the costs involved).

As we stand in 2025, Moore’s Law may be slowing in the traditional sense, but innovators are confident that “More Moore” and “More than Moore” (new capabilities beyond scaling) will continue. A recent Economist piece noted that even if transistors don’t keep halving in size every two years, the pace of progress might continue through chiplet architectures, AI-driven design, and specialization economist.com. In other words, the end of Moore’s Law won’t mean the end of rapid improvements – they’ll just come from different directions. The next few years will be exciting as we witness whether breakthroughs like High-NA EUV, 3D chip stacking, or perhaps an unforeseen new technology, propel the industry to new heights.

Geopolitical Tensions and Policy Implications

Semiconductors aren’t just business – they’re geopolitical chips in a global power game. Because advanced chips are crucial for economic strength and national security (think military technology, critical infrastructure, secure communications), nations have increasingly moved to protect and control semiconductor capabilities. Over 2024-2025, these tensions have only escalated, reshaping policy and international relations. Here are the main storylines:

- US–China Tech “Chip War”: The United States and China are locked in a fierce competition over semiconductors. The U.S. views China’s advancement in chips as a potential security threat (advanced chips can power AI for military, etc.), and has been taking strong measures to deny China access to cutting-edge chip tech. In October 2022, the U.S. announced sweeping export controls that bar Chinese companies from obtaining advanced chips (> certain performance thresholds) and the equipment to make them. In 2023 and late 2024, these restrictions were tightened further – for example, banning even some less-advanced Nvidia AI chips to China, and expanding the list of Chinese firms (like SMIC, Huawei) under sanctions deloitte.com. The U.S. also pressured allies Netherlands and Japan to restrict exports of advanced lithography and other chip tools to China, which they agreed to in early 2023 (thus cutting off China from EUV machines entirely, and even some advanced DUV tools). The goal of these curbs is to slow China’s progress in the highest-end semiconductors, especially those needed for military AI and supercomputing theregister.comm. U.S. officials openly stated they want to maintain a “small yard, high fence” – meaning a small set of the most advanced tech, but with a virtually impregnable blockade around it.

- China’s Response – Self-Reliance and Recruitments: China has not stood idle. It launched a $150+ billion “Made in China 2025” program to develop domestic semiconductor capacity and reduce reliance on foreign tech. Chinese fabs like SMIC have been making steady (if modest) progress – despite sanctions, SMIC managed to produce 7 nm chips in 2022-23 (using older DUV lithography in creative ways) patentpc.com, as seen in a Huawei smartphone launched in 2023 that teardowns revealed had a 7nm Chinese-made SoC. China is also exploiting loopholes and redoubling R&D on tools they can’t import (like developing its own lithography equipment, though still years behind). Another tactic: talent poaching. With U.S. rules barring Americans from aiding Chinese chip firms, China has aggressively recruited engineers from Taiwan, Korea, and elsewhere, offering lavish perks. “China has been aggressively recruiting expatriate talent… with high salaries, free homes, and more,” Reuters reported deloitte.com. This “talent war” is an attempt to import know-how. Additionally, China imposed its own export controls on certain materials (gallium, germanium) in mid-2023 deloitte.com, signaling it can retaliate by leveraging its dominance in some raw materials essential to semiconductors.

- CHIPS Acts and Industrial Policy: A striking development is how many governments have enacted policies to on-shore or friend-shore chip manufacturing, breaking from decades of laissez-faire approach. The United States’ CHIPS and Science Act (2022) earmarked $52.7 billion in direct funding to boost domestic chip manufacturing, plus 25% investment tax credits for fab investmentsbipartisanpolicy.org. By 2023-24, the US Commerce Department started awarding these funds to projects – for example, in 2023 it announced its first grants and loan guarantees for companies building fabs in the U.S. bipartisanpolicy.org. The goals are to raise U.S. share of global production (currently ~12%) and ensure the most advanced chips (like for defense) can be made on U.S. soil. Similarly, the EU launched its European Chips Act (2023) aiming to mobilize €43 billion to double Europe’s production share to 20% by 2030 consilium.europa.eu. This involves subsidies for new fabs (Intel got a big subsidy for a fab in Germany, TSMC is being courted for one in Germany as well), support for startups, and research funding. Japan has put up billions in subsidies too – it lured TSMC to build a fab in Kumamoto (with Sony and Denso as partners) by offering nearly half the cost (476 billion yen ≈ $3.2B subsidy) reuters.com. Japan also created Rapidus, a consortium with companies like Sony, Toyota, and backed by the government, to develop 2nm process technology domestically by partnering with IBM. South Korea announced its own incentives for a mega “semiconductor cluster” and to support its firms like Samsung in building new fabs. India rolled out a $10B incentive program to attract chipmakers to set up fabs (though as of 2024, progress has been slow, with some interest in analog/mature fabs and packaging). Even Saudi Arabia and UAE have signaled interest in investing heavily in semiconductors to diversify their economies patentpc.com. This global wave of industrial policy is unprecedented for the chip industry, which historically had a few government supports (like Taiwan’s long-term support for TSMC) but never such broad coordination. The risk is possible overcapacity in the long run and inefficient allocation, but the driving concern is national security and supply chain resilience.

- Alliances and “Friendshoring”: On the geopolitical chessboard, new alliances have formed centered on chips. The U.S. has been working to create a kind of “Chip Alliance” of like-minded tech-leading nations – often dubbed the “Chip 4” (U.S., Taiwan, South Korea, Japan) – to coordinate on supply chain security and keep critical tech out of adversaries’ hands. The Netherlands (home of ASML) is also a key partner. These countries together control most of the high-end chip IP, tools, and production. Joint statements in 2023 and 2024 between the U.S. and Japan, and U.S. and Netherlands affirmed cooperation on semiconductor controls. On the other side, China and countries in its orbit (perhaps Russia, and some others) may deepen their own tech ties – e.g. China has increased tech collaboration with Russia and seeking semiconductor equipment from any country willing to sell. The Taiwan question looms large: the U.S. explicitly says it cannot remain dependent on Taiwan for chips indefinitely (hence encouraging TSMC to build in Arizona). Taiwan, for its part, wants to maintain its “silicon shield” – the idea that the world’s dependence on its chips deters military aggression. But tensions are high – war-game scenarios and some officials’ statements have even floated extreme ideas like destroying Taiwan’s chip fabs if an invasion occurred, to prevent them from falling into Chinese hands theregister.com. This shows how semiconductors are now entangled with national defense planning.

- Higher Costs and Trade-offs: One implication of politicizing the supply chain is higher costs and inefficiencies. Morris Chang has warned that reorganizing production due to politics will drive up prices – the distributed just-in-time global model was very cost-effective theregister.com. Now, duplicating fabs in multiple countries, sometimes not at full utilization, or using suboptimal locations (from a cost perspective) means consumers may pay more for chips and chip-dependent products. Already, TSMC has stated that chips made in its new Arizona fab will cost substantially more than those made in Taiwan (some estimates ~50% higher cost) reuters.com. Companies might pass these costs on. There’s also the challenge of scaling talent and supply chains in new regions (as the TSMC Arizona delay showed, see Workforce section). Nonetheless, governments seem willing to bear those costs for security dividends.

- Export Controls and Compliance: Another development is the intricate export control regimes being established. The U.S. Commerce Department’s Bureau of Industry and Security (BIS) has been actively updating rules. For instance, in late 2024, the U.S. announced rules to restrict even advanced AI model access to sanctioned countries and curbed certain less-advanced chips that could be repurposed for military use deloitte.com. Monitoring and enforcement is a challenge – there’s a thriving gray market of chip resellers and proxies trying to get restricted chips into China or other banned destinations. In response, the U.S. is increasing enforcement actions. Meanwhile, China is crafting its own export control list (possibly to include more items like rare earth magnets, etc., beyond the metals already restricted). This cat-and-mouse game is likely to continue, with companies sometimes caught in the middle (e.g. NVIDIA had to create modified low-speed versions of its AI chips to legally sell to China under the rules, which the U.S. in turn eyed with further restrictions).

- Tech Sovereignty vs. Collaboration: Many countries are talking about “tech sovereignty” – the EU uses this term to justify investments ensuring it isn’t completely dependent on foreign tech. The flip side is that semiconductor innovation thrives on global collaboration (no one country can do it all cheaply). So policymakers have a balancing act: building local capacity without isolating themselves from the global network of suppliers and customers. The U.S. CHIPS Act actually includes provisions that funded companies cannot build advanced new capacity in China for 10 years, trying to ensure decoupling bipartisanpolicy.org. China, in turn, is promoting “self-reliance” even if it means reinventing wheels. We may see parallel ecosystems if the rift widens – for example, China developing its own EDA tools, its own equipment, albeit a generation behind. In the long run, some worry this duplication reduces the overall efficiency of innovation (since previously a company like TSMC could amortize R&D by selling to everyone globally; in a split world, volumes are lower per market).

In 2024, geopolitical tensions remain at an all-time high in the semiconductor arena. The industry pioneer Morris Chang supports the U.S. efforts to slow China – he remarked “The US started their industrial policy on chips to slow down China’s progress. … I support it,” even while acknowledging the era of free trade in chips is ending. Companies like ASML have voiced concern that some restrictions seem “more economically motivated” than purely about security reuters.com, as ASML’s CEO noted while hoping for a stable equilibrium reuters.com. Meanwhile, countries like South Korea sometimes feel caught in the middle – reliant on China as a market but allied with the U.S. For instance, South Korea was granted some flexibility (waivers) for its companies Samsung and SK Hynix to continue operating fabs in China despite U.S. rules, but in late 2024 even South Korea faced a “curveball” when thinking of its own tech policies under pressure deloitte.com.

The semiconductor “chip war” is likely to continue shaping global politics. On one hand, it’s driving huge investments in technology and capacity (which can be positive for innovation and jobs). On the other hand, it risks creating a more fractured and volatile tech landscape, where supply shocks and trade disputes become more common. For the general public, one immediate implication is that ensuring a stable supply of chips has become a top priority for governments – much like energy security. In the coming years, expect to see news of new fab groundbreakings in the U.S. heartland or European capitals, export ban tit-for-tat between major powers, and semiconductors being a key agenda item in diplomatic talks. The global competition for chip supremacy is now fully underway, and it will profoundly influence both the semiconductor industry’s evolution and the broader balance of economic power in the 21st century.

Economic Impact of the Semiconductor Industry

The semiconductor industry doesn’t just enable other sectors – it’s a massive economic force of its own. In 2024, the global semiconductor market grew sharply as pandemic shortages eased and new demand surged. Worldwide chip sales reached around $630.5 billion in 2024 semiconductors.org, marking a robust ~18–20% jump from the previous year, and are projected to hit new records in 2025 (around $697 billion) deloitte.com. If current trends hold, the industry could approach $1 trillion annually by 2030 deloitte.com. To put that in perspective, that’s roughly the GDP of the Netherlands or Indonesia generated each year by chips.

But the true economic impact of semiconductors is far larger than the sales of chips themselves. “Companies in the semiconductor ecosystem make chips … and sell them to companies that design them into systems and devices … The revenue of products that contain chips is worth tens of trillions of dollars,” explains industry expert Steve Blank steveblank.com. Indeed, virtually every modern electronic product (smartphones, PCs, cars, telecom equipment, industrial machines) contains chips – these end markets total many trillions in value and drive productivity across the entire economy. For example, semiconductors are fundamental to key industries like automotive (today’s cars have dozens of microcontrollers), computing and cloud services, telecommunications (5G networks), consumer electronics, and emerging fields like artificial intelligence and renewable energy. The availability and cost of chips directly influence the health and innovation pace of these sectors.

Some concrete points on economic impact:

- Enabling Tech Revolutions: Semiconductors are often the bottleneck or catalyst for new tech waves. The rise of smartphones and mobile internet in the 2010s was enabled by ever-more powerful and energy-efficient phone chips. The current AI boom (with ChatGPT-like models and autonomous systems) is possible because of cutting-edge GPUs and AI accelerators; if chip progress had stalled, AI algorithms couldn’t run at practical scale. The future expansion of IoT (Internet of Things), electric and self-driving cars, Industry 4.0 automation, and 6G communications all presume continued advancements in chips. In economic terms, chips have a huge multiplier effect – a breakthrough in semiconductors can unleash whole new industries. Recognizing this, governments call semiconductors a “strategic” industry; for instance, the White House stated that semiconductors are “critical to U.S. economic growth and national security”, underlying why the CHIPS Act was justified bipartisanpolicy.org.

- Job Creation and High-Skill Employment: The semiconductor sector supports a large number of jobs worldwide, many of them high-paying skilled positions (engineers, technicians, researchers). In chip design hubs like Silicon Valley (USA) or Hsinchu (Taiwan), chip companies are major employers. A single new fab can create thousands of direct jobs and tens of thousands of indirect jobs (construction, suppliers, services). For example, Intel’s planned fabs in Ohio and TSMC’s in Arizona are each expected to create ~3,000 direct jobs plus much more in the broader economy. Moreover, these are exactly the kind of advanced manufacturing jobs that many developed countries are keen to have domestically for economic and security reasons. However, as we’ll discuss in the next section, finding qualified talent for these jobs is a growing challenge, which itself has economic implications (labor constraints can slow expansion and drive wages up).

- Global Trade and Supply Chains: Semiconductors are one of the most traded products globally. Annual global trade in semiconductors and related equipment runs into hundreds of billions. For instance, chips are consistently among the top exports for countries like Taiwan, South Korea, Malaysia, and increasingly China (which exports a lot of lower-end chips even as it imports high-end ones). In fact, since 2020, China’s chip imports (around $350B in 2022) have exceeded its oil imports, highlighting chips as a crucial import commodity for the country patentpc.com. This dynamic also plays into trade balances and negotiations. Export-heavy economies like South Korea and Taiwan depend on chip exports for growth – in Taiwan, TSMC alone is a major contributor to GDP and trade surplus. Meanwhile, countries that rely on importing chips (like many in Europe, or India) see improving their trade position as one reason to develop domestic production.

- Economic Security: The 2021-2022 chip shortage served as a wake-up call: a shortage of $1 semiconductor parts was enough to halt production of $40,000 cars, contributing to inflation and lower GDP growth in some regions. Studies estimated the chip shortage trimmed several percentage points off auto production globally and slowed consumer electronics availability, which likely had a minor dampening effect on GDP in 2021. Governments now treat assured chip supply as part of economic security. A PwC report in 2023 even warned that a serious climate-change-induced disruption to chip supply could put one-third of the projected $1 trillion output at risk within a decade if industry doesn’t adapt pwc.com – which would significantly hurt the global economy. So, economic planners are integrating semiconductors into risk assessments usually reserved for essential commodities.

- Stock Market and Corporate Growth: Semiconductor companies themselves have become some of the most valuable companies in the world. By late 2024, the combined market capitalization of the top 10 chip firms was about $6.5 trillion, up 93% from a year before deloitte.com, thanks to surging AI-related valuations. Giants like TSMC, NVIDIA, Samsung, Intel, and ASML each have market caps in the hundreds of billions. These companies’ performance heavily influences stock indices and investment flows. In fact, the Philadelphia Semiconductor Index (SOX) is often seen as a barometer of tech sector health. The wealth created by the rise of these firms is enormous, and they in turn plow money back into R&D and capital spending at record levels (TSMC spent ~$36B in capex in 2022 reuters.com, which is akin to building several aircraft carriers in cost). This creates a virtuous cycle of innovation and economic activity, as long as demand keeps up.

- Consumer Impact and Prices: Chips are a big component of the cost in many products. As chips get more powerful (per Moore’s Law) often the cost per function goes down, enabling cheaper electronics or more features for the same price – a boon for consumers and productivity. However, the recent supply crunch and the added costs of “secure” supply chains (e.g., duplicating fabs in higher-cost regions) may exert inflationary pressure. We saw, for instance, car prices jump significantly in 2021-2022 partly because automakers couldn’t get enough microcontrollers, leading to low inventories. A report by Goldman Sachs in 2021 found chips feed into a wide range of consumer goods, so a prolonged chip shortage can impact inflation by a noticeable fraction of a percent. Conversely, when chip supply normalizes, it can have a deflationary effect on electronics prices. Over the long term, the continued progress in semiconductors is a deflationary force (electronics either drop in price or get far more capable at the same price each year).

- Government Subsidies and ROI: With tens of billions of public funds now committed to chip initiatives, taxpayers and economists are watching the returns. Proponents argue these subsidies will pay off via high-value job creation and safeguarding industries that are essential. There’s also the multiplier effect – e.g. building a fab involves lots of construction work and then high-skilled jobs, and each fab job reportedly supports ~4–5 other jobs in the economy (in maintenance, services, etc.). However, critics caution about oversupply or the inefficiency of government picking winners. The CHIPS Act funding, for example, comes with strings (profit-sharing if excessive profits, childcare requirements for fab workers, etc.) to try to ensure broad benefits. The success or failure of these policies will have economic ripple effects: if they succeed, regions like the American Midwest or Saxony in Germany could become new Silicon Valleys, boosting local economies. If not, there’s risk of expensive white elephants.

In summary, semiconductors have a huge economic impact both directly and indirectly. They drive growth in complementary industries and are at the heart of productivity gains (faster computers = more scientific simulations, better AI = more automation). The sector’s cyclical nature (boom-bust cycles due to demand fluctuations) can also affect broader economic cycles. For instance, a downturn in the chip cycle (like in 2019 or 2023 for memory chips) can hurt exports and GDP of manufacturing-heavy economies, while an upturn (like the current AI boom) can supercharge them.

As we head into 2025, the outlook is optimistic: Deloitte’s industry outlook noted that 2024 was very robust with ~19% growth, and 2025 could see another ~11% growth, putting the industry on track for that trillion-dollar aspiration deloitte.com. The growth is fueled by emerging tech demand (AI, 5G, electric vehicles) compensating for any slowdown in smartphones or PCs. The challenge will be navigating the costs of localization and geopolitical constraints without stifling the innovation and scale that made semiconductors such an economic success story in the first place.

Environmental and Sustainability Concerns

As dazzling as semiconductor technology is, its production comes with significant environmental costs. The industry is increasingly reckoning with its sustainability challenges – including enormous water and energy usage, greenhouse gas emissions, and chemical waste. Paradoxically, while chips enable greener technologies (like efficient electronics and clean energy solutions), making those chips can be resource-intensive and polluting if not managed carefully. Here are the key environmental concerns:

- Water Usage: “Semiconductors cannot exist without water – a lot of it,” notes Kirsten James of Ceres weforum.org. Fabs require vast quantities of ultra-pure water (UPW) to rinse wafers after each chemical process. This water must be extremely pure (thousands of times purer than drinking water) to avoid any mineral or particle contamination weforum.org. To produce 1,000 gallons of UPW, roughly 1,400–1,600 gallons of municipal water are needed (the rest becomes wastewater) weforum.org. A single large chip fab can use 10 million gallons of water per day, equivalent to the water consumption of ~30,000–40,000 households weforum.org. Globally, all semiconductor plants combined are estimated to consume water on the order of a city of millions; one report noted chip factories worldwide use as much water as the city of Hong Kong (7.5 million people) each year weforum.org. This heavy demand puts pressure on local water supplies, especially in regions already facing drought or water stress (e.g. TSMC’s fabs in Taiwan were threatened by a severe drought in 2021, requiring government water rationing and even trucking in water to fabs). Water scarcity is becoming a vulnerability for the industry weforum.org. Moreover, the water discharge from fabs can contain hazardous chemicals (like acids, metals). Without proper treatment, this wastewater can pollute rivers and groundwater, harming ecosystems weforum.org. Indeed, in some chip hubs in China and South Korea, authorities have cited fabs for environmental violations due to water pollution weforum.org. The industry is responding by investing in water recycling: many fabs now recycle a portion of their water. For example, TSMC’s new Arizona fab claims it will reclaim about 65% of its water usage on-site weforum.org, and Intel partnered with local authorities in Oregon and Arizona to build water treatment plants to replenish aquifers weforum.org. Some fabs in Singapore and Israel recycle even higher percentages. However, as chip demand grows, overall water usage is still set to rise, making this a critical sustainability issue.

- Energy Consumption and Emissions: Chip manufacturing is energy-intensive. Running a fab’s cleanrooms, pumps, and thermal processes 24/7 draws enormous power. A single advanced fab can consume on the order of 100 megawatts of electricity continuously – equivalent to the power use of a small city (tens of thousands of homes). In fact, “a standard large chip fabrication facility consumes over 100,000 megawatts of energy … every single day,” and the sector as a whole used about 190 million tons of CO₂-equivalent in 2024 blog.veolianorthamerica.com. (That emissions figure – 190 million tons – is roughly the annual emissions of countries like Vietnam or Australia.) Some of this carbon footprint comes from indirect power use (if the local grid is fossil-fueled), and part comes from direct process emissions. Fabs use perfluorinated compounds (PFCs) for etching and cleaning; these gases, like CF₄ or C₂F₆, have global warming potentials thousands of times higher than CO₂ and can persist in the atmosphere for millennia. Although the industry has worked to curb PFC leaks (as part of voluntary agreements under the Kyoto Protocol), they still contribute a meaningful chunk of emissions. According to a study by TechInsights, if chip production doubles by 2030 (to meet $1T market), without mitigation the industry’s emissions could rise significantly pwc.com. To address energy use, chipmakers are increasingly investing in renewable energy to power fabs. TSMC, for instance, has become one of the world’s largest corporate buyers of renewable power, aiming for 40% renewable by 2030 and 100% by 2050. Intel too has fabs on 100% renewable electricity in some locations. Improving energy efficiency within fabs (e.g. using heat recovery, more efficient chillers) is another focus. But importantly, more advanced chips often require more energy per wafer to produce (e.g. EUV lithography is less energy-efficient than older lithography), so there’s a tension between technology advancement and energy per chip. Some analysts worry that if Moore’s Law slows, the energy per transistor might actually increase.

- Chemical and Hazardous Waste: The semiconductor process employs toxic and hazardous substances – gases like silane or arsine, corrosive liquids (acids, solvents), and heavy metals. Managing waste streams safely is crucial. Fabs generate chemical waste that must be carefully treated or disposed of. For example, used solvents and etchants can be distilled and recycled, acids neutralized, and slurries filtered for reuse. Companies like Veolia have services specifically to help fabs with waste recycling – converting spent chemicals into useful products or safely incinerating waste and capturing energy blog.veolianorthamerica.com. Despite best practices, accidents (chemical leaks, improper dumping) can and have occurred, which could cause local environmental harm. Another aspect is the packaging waste – manufacturing involves lots of single-use plastic containers, gloves, gowns, etc., in cleanrooms. Many firms are now trying to reduce and recycle this solid waste as well blog.veolianorthamerica.com. There’s also e-waste downstream, but that’s more about disposal of finished electronic products rather than chip fabrication itself.

- Climate Change Resilience: Ironically, climate change poses a direct threat to chip production even as chips will be needed to combat climate change. Fabs are located in places increasingly experiencing extreme weather: typhoons in East Asia, heat waves and droughts (e.g., the Western U.S., Taiwan), etc. A 2024 CNBC report highlighted how a single storm or flood hitting a key “chip town” could upend supply – for instance, a hypothetical typhoon Helene hitting the Taiwanese city of Hsinchu (where TSMC’s headquarters is) could be catastrophic deloitte.com. Companies are now evaluating climate risks for their facilities. Water stress is top of mind – a 2023 survey of chip executives found 73% were concerned about natural resource risks (water) to their operations weforum.org. Many are incorporating climate resilience, such as building onsite water storage, backup power, and diversifying geographic locations. PricewaterhouseCoopers warned that without adaptation, up to 32% of global semiconductor supply is at risk by 2030 due to climate-related water stress and other climate impacts pwc.com.

- Positive Initiatives: On the brighter side, the industry has stepped up sustainability commitments. By 2025, nearly all major semiconductor firms have some form of carbon reduction or neutrality goal. TSMC aims to reduce emissions by 20% by 2030 (from 2020 baseline) and net zero by 2050. Intel has a 2040 net-zero operational emissions goal and is investing in green fabs (it already achieved 82% water reuse and 100% green power in U.S. sites as of 2022). Samsung announced environmental targets to match – e.g., sourcing renewable energy for overseas operations and improving energy efficiency of its processes. Another positive is the industry’s product helps reduce emissions elsewhere – for example, power-efficient chips lower energy use in data centers and electronics; chips in renewable energy systems improve grid efficiency. One study by SIA (Semiconductor Industry Association) suggested that for every ton of CO₂ emitted by the chip sector, the technologies enabled by chips helped reduce several tons in other sectors (through energy savings). Whether that offsets the footprint is debated, but it’s clear semiconductors are key to climate solutions (smart grids, EVs, etc.).

To illustrate the strides being made: Sony’s semiconductor arm in Japan said one of its fabs reuses about 80% of its wastewater and is building new recycling facilities to improve that weforum.org. Many companies have joined the Responsible Business Alliance initiatives for sustainable supply chains, ensuring the minerals they use (e.g. cobalt, tantalum) are conflict-free and mined responsibly. And consortia are forming to address pervasive issues collectively – e.g., IMEC in Belgium runs programs on sustainable semiconductor manufacturing, exploring alternatives to PFC gases and ways to reduce energy per wafer.

In conclusion, semiconductor manufacturing’s environmental impact is non-trivial and must be managed. The good news is that industry leaders acknowledge this. As one Deloitte report put it, making a trillion dollars’ worth of chips in 2030 will have an environmental impact – the question is how to mitigate It www2.deloitte.com. The path forward includes greater transparency (firms disclosing water and carbon data), setting science-based targets for emissions, investing in circular economy practices (like chemical reuse, zero waste to landfill goals blog.veolianorthamerica.com), and partnering with governments (for infrastructure like renewable energy and water treatment). Consumers and investors are also pushing for greener practices – major chip buyers like Apple, for instance, want their supply chain (including chip suppliers like TSMC) to use 100% renewable energy. This external pressure helps compel change.

So, while the chip industry has some work to do to reduce its environmental footprint, it’s making meaningful moves. After all, saving water and energy often aligns with saving costs long-term. And in a world where sustainability is increasingly paramount, excelling in “green chipmaking” might become another competitive advantage. We may even see technologies like new dry etching methods (using less chemicals) or substitutes for PFC gases emerge as standard practice, driven by eco-conscious R&D. The hope is that the next phase of semiconductor growth can be achieved in a way that works with the environment, not against it blog.veolianorthamerica.com – ensuring that the chip-fueled digital revolution is sustainable for the planet.

Workforce and Talent Challenges

Semiconductor production isn’t just about cleanrooms and machines – it fundamentally relies on people with highly specialized skills. And here, the industry faces a critical challenge: a growing talent shortage and skills gap. As nations invest in new fabs and R&D, the question arises: who will staff these facilities and drive innovation, especially in an era when the existing workforce is aging and younger talent is gravitating to software or other fields?

Key issues and developments regarding the semiconductor workforce:

- Aging Workforce & Retirement Wave: In many regions, the current semiconductor engineering workforce is skewed toward older, experienced professionals – and a large cohort is nearing retirement. For instance, in the United States “55% of the semiconductor workforce is above 45 years old, while less than 25% is under 35,” as of mid-2024 deloitte.com. Europe is similar: “20% of Europe’s semiconductor workers are above 55, and about 30% of Germany’s semiconductor workforce is expected to retire in the next decade,” according to an EE Times analysis deloitte.com. This is a looming “brain drain” as veteran experts leave. The industry risks losing decades of institutional knowledge faster than it can replace it – a fact noted in Deloitte’s talent study, which warned of “inconsistent knowledge transfer and too few new entrants to absorb expertise” deloitte.com.

- Insufficient New Talent Pipeline: Historically, careers in chip engineering (whether electrical engineering, materials science, or equipment maintenance) haven’t attracted as large a pool of young talent as, say, software development or data science. The work is often seen as more specialized, requiring advanced degrees, and the industry’s profile among graduates has dimmed since the PC boom days. A joint SEMI-Deloitte study back in 2017 already highlighted a “looming talent gap” and noted that the semiconductor industry struggles with branding and value proposition to new grads deloitte.com. In 2023-2024, despite the high-tech nature of the field, fewer students choose semiconductor-related fields, and companies report difficulty filling positions from entry-level up through Ph.D. researchers. The result: many job openings, few qualified applicants. This is especially acute in regions trying to expand chip manufacturing from a low base (e.g., the U.S., which needs to train many more technicians for its new fabs, or India’s nascent efforts).

- Regional Mismatches and TSMC’s Arizona Lesson: One headline example of talent issues was TSMC’s delay in Arizona. TSMC is building a $40 billion fab in Arizona – one of the cornerstones of the U.S.’s bid to onshore advanced chipmaking. However, in mid-2023 TSMC announced the plant’s opening would be pushed from 2024 to 2025, citing “an insufficient amount of skilled workers” in the local workforce manufacturingdive.com. The company struggled to find enough U.S. workers with the specialized know-how for construction and installation of advanced fab equipment, and it met with “pushback from unions on efforts to bring in workers from Taiwan” to helpreuters.com. TSMC had to dispatch hundreds of experienced technicians from Taiwan to Arizona to train locals and finish cleanroom installation. The company’s chairman Mark Liu noted that every new project has a learning curve but implied the U.S. labor shortage was a serious hurdle reuters.com. This scenario underscores that expertise is concentrated in existing hubs (like Taiwan for leading-edge fabrication) and doesn’t easily relocate. Now U.S. fab projects (Intel’s new fabs, Samsung’s Texas fab expansion, etc.) are all intensifying recruitment and training, working with community colleges and engineering schools to develop talent. But training a fresh graduate to become a seasoned semiconductor process engineer can take years of on-the-job experience. So, the ramp-up of domestic talent may lag the ramp-up of factory construction.

- China’s Talent Drive: Meanwhile, China is aggressively headhunting chip talent globally to overcome its tech constraints. As noted, with Western countries limiting tech transfer, China has turned to recruiting individuals. A Reuters investigation in 2023 found China quietly hired hundreds of engineers from Taiwan’s TSMC and other companies, offering compensation packages sometimes double their salary plus perks like housing deloitte.com. The idea is to import expertise to Chinese fabs and design houses (somewhat mirroring how Taiwan originally bootstrapped its industry by bringing back engineers trained in the U.S. in the 1980s). However, this has caused tension – Taiwan has even launched probes and tightened laws to prevent IP leakage via talent poaching. The U.S. also now forbids its citizens (and green card holders) from working for certain Chinese chip firms without a license deloitte.com, after it noticed many ex-employees of American firms taking lucrative gigs in China. Nonetheless, the “talent war” means experienced engineers globally are in high demand, and salaries are being bid up. This is great for engineers, but it can be problematic for companies and regions that can’t match the pay on offer from wealthier suitors (be it a state-subsidized Chinese startup or a U.S. CHIPS Act-funded fab).

- Training and Education Initiatives: Recognizing the talent bottleneck, numerous initiatives have sprung up. Under the CHIPS Act, the U.S. has allocated funds not just for fabs but also for workforce development – partnering with universities and community colleges to create new semiconductor education programs bipartisanpolicy.org. For example, Purdue University launched a Semiconductor Degrees Program aiming to graduate hundreds of chip-trained engineers yearly, and Arizona State University is expanding programs to support TSMC’s presence. Likewise, Europe’s Chips Act includes scholarships and cross-country training networks to foster more microelectronics experts. Companies are also upping internal training; Intel, for instance, runs a long-standing “college for fabs” internally and is expanding internships and co-op programs. One challenge, however, is that a lot of tacit knowledge in chipmaking isn’t taught in textbooks – it’s learned by doing in fabs. So, scaling up talent will require a combination of formal education and practical apprenticeships at existing facilities. Governments may even relax immigration rules to attract foreign talent (the U.S. is considering a special visa category for chip experts, and Japan has been courting Taiwanese and Korean engineers to staff Rapidus).