- Super micro shares are democratising investment, allowing individuals with limited budgets to hold pieces of promising ventures.

- This model disrupts traditional financing, offering alternative financial support to ventures outside of high-cost IPOs.

- Blockchain technology provides secure and transparent distributed share trading, attracting tech-savvy millennials and Gen Z investors.

- As this trend grows, super micro shares could reshape global investment strategies and alter the dynamics of financial market power.

- Potential risks include volatility, regulatory challenges, and liquidity issues; paralleling the challenges of traditional investments.

- Technology and digital platforms empower investors with dynamic tools for informed decision-making.

- Super micro shares have the potential to transform financial inclusion and redefine the global economic narrative.

Step into the fascinating world of super micro shares; a beacon of innovation poised to redefine investment in new markets. Imagine a marketplace where you can purchase a piece of a promising venture with just a few pounds; standing shoulder to shoulder with venture capitalists. In this new era of investment, access is becoming democratic, and barriers are being dismantled.

The allure of super micro shares lies in their accessibility. They offer investors the opportunity to partake in technology ventures with high growth potential that once seemed out of reach. This model enables ordinary individuals to have a stake in the future of technological innovation. Democratisation goes far beyond the wallet – the very concept is shaking up traditional funding, providing financial support to ventures outside of high-cost IPOs.

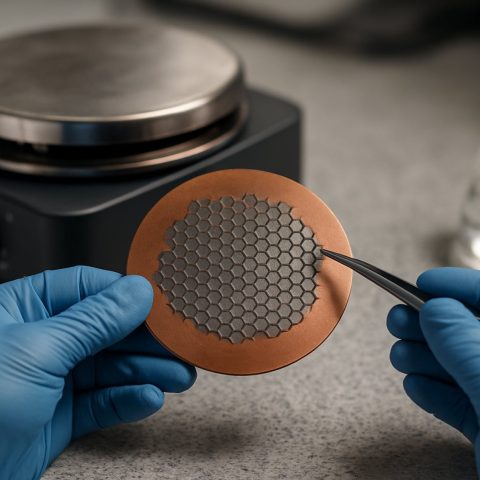

Imagine individuals weaving a rich tapestry of diverse investments, easily balancing risks. The backbone of this revolution, blockchain technology, opens a secure and transparent avenue for distributed share trading. It’s no surprise that tech-savvy millennials and Gen Z investors are flocking to these digital-first investments; they seek agility and transparency in their financial goals.

As this trend gains momentum, envision super micro shares reshaping investment strategies worldwide. This shift not only attracts a new wave of retail investors but also plays with the power dynamics in financial markets. Could the international economic compass be taking its bearings from here?

Yet, as captivating as this prospect is, super micro shares carry their own unique shadows. Emerging ventures bring inherent risks, and these distributed shares often reflect the volatility of their full-sized counterparts. The regulatory landscape is evolving rapidly, presenting potential legal issues. Moreover, liquidity poses a challenge; complex transactions obscure easy entry and exit for investors.

Nevertheless, technology continues to be the driving force behind this phenomenon. While blockchain provides a layer of trust rarely seen, digital platforms and analytical tools equip investors with the means to make informed decisions on the go.

In a world where financial inclusion has become the norm, super micro shares are ready to transform. With challenges to face and opportunities to evaluate, perhaps these will be the next frontier in the investment world. As the landscape evolves, will you join the wave of pioneers redefining the global economic narrative?

Super Micro Shares: The Next Big Trend in Investment?

Understanding Super Micro Shares

Super micro shares represent an exciting development in the investment world, providing access to new technology ventures with minimal capital. This innovative approach democratizes the investment landscape, allowing retail investors to enter markets that were previously dominated by institutional players.

—

Extra Information and Insights

How Super Micro Shares Work

Super micro shares allow investors to purchase distributed shares of ventures through digital platforms supported by blockchain technology. This broadens market access by offering investors lower entry points into companies showing potential for high growth.

Technology Foundation: Blockchain

Blockchain technology plays a critical role in making super micro shares a reality. It provides transparency and security in transactions, making them more trustworthy. Investors benefit from reduced risks of fraud and a clear transaction record; this is frequently noted in various fintech reports.

Market Predictions & Sector Trends

The super micro shares market is expected to grow significantly over the next decade. According to a recent survey by Bloomberg, blockchain-based trading platforms could capture significant market share as they attract more tech-savvy retail investors seeking alternative investment channels.

Regulatory Environment

The regulatory framework for super micro shares is still evolving. Authorities are striving to create regulations that protect investors while encouraging innovation. The SEC in the US is actively reviewing such community-focused platforms, but a robust regulatory environment has yet to be fully implemented.

Discussions & Limitations

1. Volatility: Like micro-shares, super micro shares can also be highly volatile. The value of these shares can fluctuate sharply due to market sentiment or venture performance.

2. Liquidity Challenges: Exiting investments can be complex; hence, it is critical for investors to consider their liquidity needs before purchasing distributed shares.

3. Speculative Risk: Given that ventures may fail, these investments carry speculative risk that requires in-depth research and risk tolerance.

Real-World Use Cases

Platforms like Robinhood and public.com are offering distributed shares, providing an experiential basis. These platforms popularise the concept, showcasing how ordinary investors can build wealth similarly to larger investors.

—

Tips for Investing in Super Micro Shares

1. Conduct Thorough Research: Investigate the venture’s business model, market position, and potential for growth before investing. Resources like Crunchbase can be very valuable.

2. Diversify Your Investments: Spread investments across various sectors to effectively manage risks.

3. Stay Updated: Keep track of market news and trends. Subscribing to financial news sites can provide useful updates.

4. Leverage Technology: Use financial analytical tools to track and forecast investment performance.

—

Actionable Recommendations

– Start Small: Consider making a small investment to understand the market dynamics.

– Educate Yourself: Take online courses related to blockchain and distributed investments to make informed decisions.

– Network with Peers: Engage with online finance communities and gather insights from those with experience in super micro shares.

– Review Regularly: Regularly assess your portfolio to ensure alignment with your investment goals.

As you consider stepping into the vibrant world of super micro shares, being informed and strategic could transform how you invest in today’s new markets.

For further exploration of current investment trends, visit CNBC for expert insights and analyses.